Dong Nam Economic Zone with High

Investment Incentives

Foreign investment in Vietnam has continued to grow strongly in recent years, which is one of the powerful forces driving the growth of Vietnam's economy. The Vietnamese government has been renewing and reforming many regulations to create optimal conditions for foreign investors. In addition to the reform of regulations and legal procedures, it can be considered that Vietnam investment incentives have also contributed significantly to attracting foreign investment into Vietnam.

In general, Vietnam investment incentives make a very significant contribution to the economy. Preferential policies ensure the goal of global economic integration, and at the same time encourage the establishment of new businesses, improve production capacity, and address the demand for domestic workers. In addition, Vietnam investment incentives also contribute to positive economic restructuring between regions of Vietnam and overall, to promote economic growth.

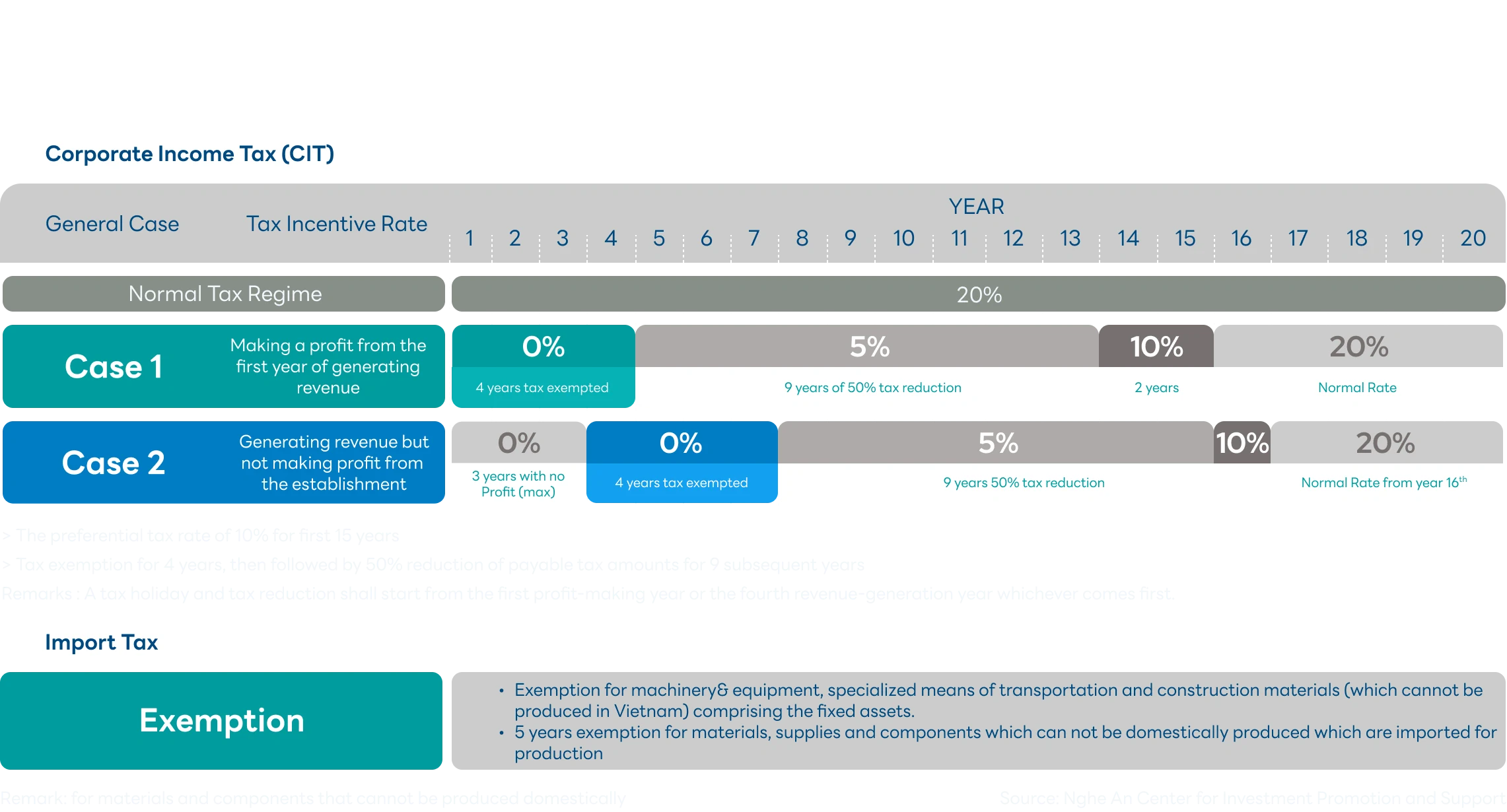

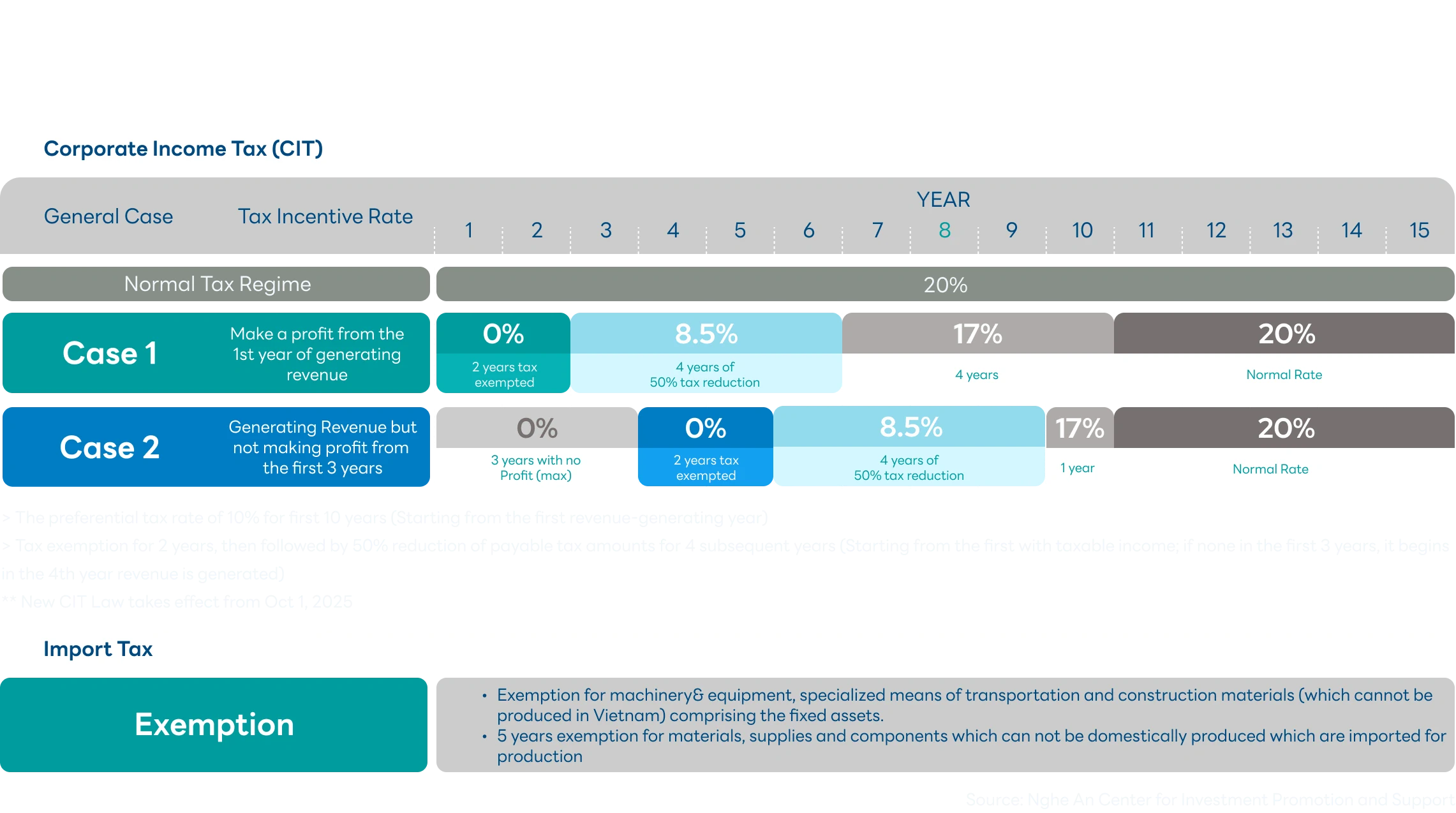

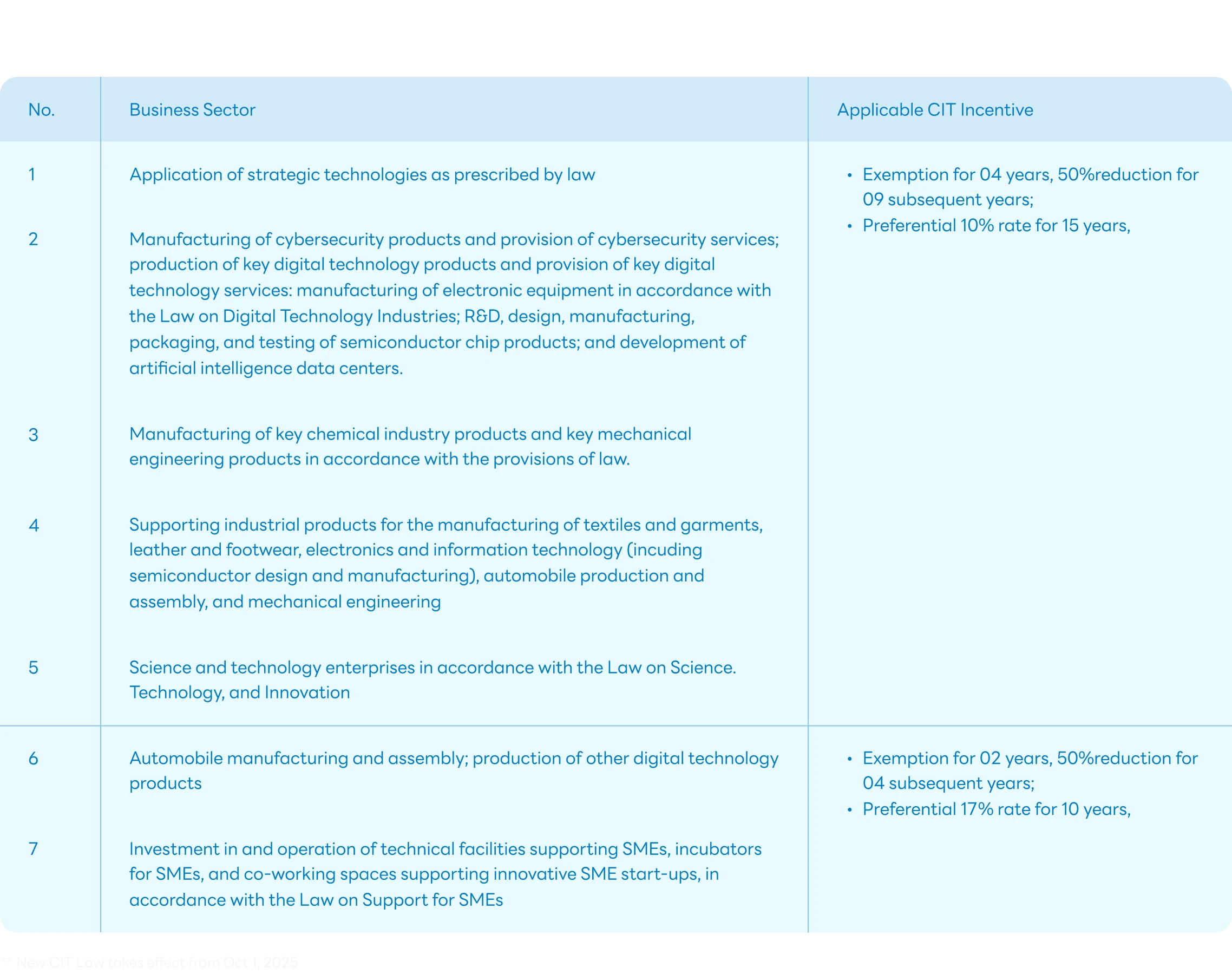

Vietnam investment incentives at WHA Industrial Zone 1 – Nghe An attracts domestic and foreign investment. The tax incentives include exemptions or reductions of Corporate Income Tax (CIT) and Import Tax. Located at Dong Nam Economic Zone, WHA Industrial Zone 1 – Nghe An can provide investor support with one-stop service to start running the operation in the short period of time.

- Speacial taxt rate: 10% for 15 years

- CIT exemption for the first 4 years

- 50% tax reduction in the subsequent 9 years

- Exemption for machines and equipment to create fixed asset

- Exemption in 5 years for materials & components of production that cannot be produced domestically

One Stop Service at Dong Nam Economic Zone Authority